- Home

- OXLC

as 07-11-2025 4:00pm EST

Oxford Lane Capital Corp is a non-diversified closed-end management investment company. The fund's investment objective is to maximize its portfolio's risk-adjusted total return over its investment horizon. Its current focus is to seek that return by investing in equity and junior tranches of CLO(collateralized loan obligation) vehicles, which are collateralized by a diverse portfolio of senior loans, and which generally have little to no exposure to real estate loans, mortgage loans or pools of consumer-based debt, such as credit card receivables or auto loans. Its investment plan also includes investing in warehouse facilities, which are financing structures intended to aggregate senior loans that may be used to form the basis of a CLO vehicle.

| Founded: | 2010 | Country: | United States |

| Employees: | N/A | City: | N/A |

| Market Cap: | 2.0B | IPO Year: | N/A |

| Target Price: | $6.00 | AVG Volume (30 days): | 1.9M |

| Analyst Decision: | Strong Buy | Number of Analysts: | 1 |

| Dividend Yield: | Dividend Payout Frequency: | Monthly | |

| EPS: | 1.20 | EPS Growth: | -61.78 |

| 52 Week Low/High: | $4.41 - $5.70 | Next Earning Date: | 11-01-2023 |

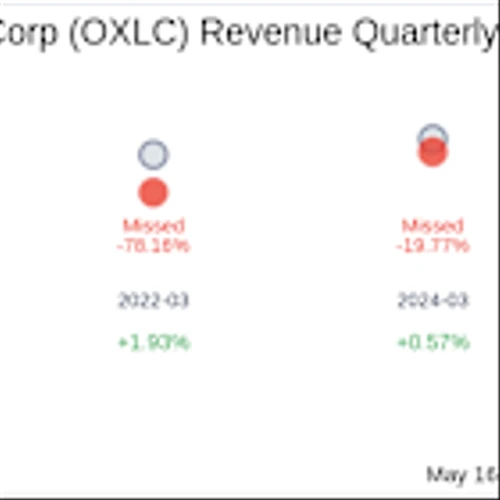

| Revenue: | $130,145,365 | Revenue Growth: | -55.64% |

| Revenue Growth (this year): | 136.15% | Revenue Growth (next year): | 5.51% |

Latest Oxford Lane Capital Corp. News

OXLC Breaking Stock News: Dive into OXLC Ticker-Specific Updates for Smart Investing

GlobeNewswire

a month ago

Oxford Lane Capital Corp. Provides May 2025 Net Asset Value Update

GuruFocus.com

2 months ago

Oxford Lane Capital Corp (OXLC) Q4 2025 Earnings Call Highlights: Navigating Market Challenges ...

Thomson Reuters StreetEvents

2 months ago

Q4 2025 Oxford Lane Capital Corp Earnings Call

MT Newswires

2 months ago

Oxford Lane Capital Fiscal Q4 Core Income, Net Asset Value Miss Expectations; Shares Down Pre-Bell

GlobeNewswire

2 months ago

Oxford Lane Capital Corp. Announces Net Asset Value and Selected Financial Results for the Fourth Fiscal Quarter and Provides April Net Asset Value Update

GuruFocus.com

2 months ago

Oxford Lane Capital Corp (OXLC) Q4 2025 Earnings Report Preview: What to Expect

GlobeNewswire

2 months ago

Oxford Lane Capital Corp. Awarded “Best Public Closed‐End CLO Fund” by Creditflux

GlobeNewswire

2 months ago

Oxford Lane Capital Corp. Schedules Fourth Fiscal Quarter Earnings Release and Conference Call for May 19, 2025

Compare OXLC vs Leading Stocks

Share on Social Networks:

Disclaimer

The information presented on this page, "OXLC Oxford Lane Capital Corp. - Stocks Price | History | Analysis", including historical data, forecasts, news, insider information, and predictions, is provided for educational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities. Decisions regarding investments should be made only after careful consideration and consultation with a qualified financial advisor. We do not endorse or guarantee the accuracy or reliability of the information provided, and we disclaim any liability for financial losses incurred as a result of decisions made based on the information presented.