- Home

- ZTS

ZTS

Zoetis Inc.

as of 03-09-2026 3:53pm EST

Zoetis sells anti-infectives, vaccines, parasiticides, diagnostics, and other health products for animals. The firm earns roughly 35% of total revenue from production animals (cattle, pigs, poultry, and so on) and nearly 65% from companion animal (dogs, horses, cats) products. Its USA business is skewed even more heavily toward companion animals, while its international business is slightly skewed toward production animals. The firm has the largest market share in the industry and was previously Pfizer's animal health unit.

| Founded: | 1952 | Country: | United States |

| Employees: | N/A | City: | PARSIPPANY |

| Market Cap: | 54.8B | IPO Year: | 2012 |

| Target Price: | $156.20 | AVG Volume (30 days): | 4.0M |

| Analyst Decision: | Buy | Number of Analysts: | 11 |

| Dividend Yield: | Dividend Payout Frequency: | quarterly | |

| EPS: | 6.02 | EPS Growth: | 10.05 |

| 52 Week Low/High: | $115.25 - $172.23 | Next Earning Date: | 05-14-2026 |

| Revenue: | $9,467,000,000 | Revenue Growth: | 2.28% |

| Revenue Growth (this year): | 5.69% | Revenue Growth (next year): | 4.81% |

| P/E Ratio: | 20.17 | Index: | |

| Free Cash Flow: | 2.3B | FCF Growth: | -0.65% |

Stock Insider Trading Activity of Zoetis Inc. (ZTS)

Chief Executive Officer

Avg Cost/Share

$127.00

Shares

20,000

Total Value

$2,540,964.28

Owned After

112,137

| Insider | Ticker | Relationship | Date | Transaction | Avg Cost | Shares | Total Value | Owned After | SEC Forms |

|---|---|---|---|---|---|---|---|---|---|

| PECK KRISTIN C | ZTS | Chief Executive Officer | Feb 17, 2026 | Sell | $127.00 | 20,000 | $2,540,964.28 | 112,137 |

Earnings Transcripts

SEC 8-K filings with transcript text

2025 Q4 Q4 2025 Earnings

8-K BUY Feb 12, 2026 · 100% conf.

Q4 2025 Earnings

8-K BUYFeb 12, 2026 · 100% conf.

1D

+1.38%

$127.37

5D

+3.29%

$129.78

20D

+4.58%

$131.39

zts-202602120001555280false00015552802026-02-122026-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 12, 2026

Zoetis Inc. (Exact name of registrant as specified in its charter)

Delaware001-3579746-0696167 (State or other jurisdiction(Commission File(I.R.S. Employer of incorporation)Number)Identification No.)

10 Sylvan Way, Parsippany, New Jersey 07054 (Address of principal executive offices)(Zip Code)

(973) 822-7000

(Registrant's telephone number, including area code)

Not Applicable (Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: Title of each classTrading Symbol(s)Name of each exchange on which registered Common Stock, par value $0.01 per shareZTSNew York Stock Exchange

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition On February 12, 2026, Zoetis Inc. (the Company) issued a press release announcing its financial results for the fourth quarter and full year 2025 and providing its guidance for full year 2026. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information in this Item 2.02 and in the attached Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits 99.1 Press Release of Zoetis Inc. dated February 12, 2026, reporting Zoetis' financial results for the fourth quarter and full year 2025 and providing its guidance for full year 2026

EX-101.INSInline XBRL INSTANCE DOCUMENT

EX-101.SCHInline XBRL TAXONOMY EXTENSION SCHEMA DOCUMENT

EX-101.CALInline XBRL TAXONOMY EXTENSION CALCULATION LINKBASE DOCUMENT

EX-101.LABInline XBRL TAXONOMY EXTENSION LABEL LINKBASE DOCUMENT

EX-101.PREInline XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE DOCUMENT

EX-101.DEFInline XBRL TAXONOMY EXTENSION DEFINITION LINKBASE DOCUMENT

104Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. Zoetis Inc.

February 12, 2026 By:/s/ WETTENY JOSEPH

Wetteny Joseph Executive Vice President and Chief Financial Officer

2025 Q3 Q3 2025 Earnings

8-K Nov 4, 2025

Q3 2025 Earnings

8-KNov 4, 2025

zts-202511040001555280false00015552802025-11-042025-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 4, 2025

Zoetis Inc. (Exact name of registrant as specified in its charter)

Delaware001-3579746-0696167 (State or other jurisdiction(Commission File(I.R.S. Employer of incorporation)Number)Identification No.)

10 Sylvan Way Parsippany New Jersey 07054 (Address of principal executive offices)(Zip Code)

(973) 822-7000

(Registrant's telephone number, including area code)

Not Applicable (Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: Title of each classTrading Symbol(s)Name of each exchange on which registered Common Stock, par value $0.01 per shareZTSNew York Stock Exchange

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 4, 2025, Zoetis Inc. (the Company) issued a press release reporting its financial results for the third quarter of 2025 and its guidance for full year 2025. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and the attached Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. Item 9.01 Financial Statements and Exhibits

(d) Exhibits Exhibit No.Description

99.1 Press Release of Zoetis Inc. dated November 4, 2025, reporting Zoetis' financial results for the

third quarter of 2025 and its guidance for full year 2025.

EX-101.INSInline XBRL INSTANCE DOCUMENT

EX-101.SCHInline XBRL TAXONOMY EXTENSION SCHEMA DOCUMENT

EX-101.CALInline XBRL TAXONOMY EXTENSION CALCULATION LINKBASE DOCUMENT

EX-101.LABInline XBRL TAXONOMY EXTENSION LABEL LINKBASE DOCUMENT

EX-101.PREInline XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE DOCUMENT

EX-101.DEFInline XBRL TAXONOMY EXTENSION DEFINITION LINKBASE DOCUMENT

104Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

SIGNATURE

Under the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the authorized undersigned.

Zoetis Inc.

November 4, 2025 By:/S/ WETTENY JOSEPH Wetteny Joseph Executive Vice President and Chief Financial Officer

2025 Q2 Q2 2025 Earnings

8-K Aug 5, 2025

Q2 2025 Earnings

8-KAug 5, 2025

zts-202508050001555280false00015552802025-08-052025-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 5, 2025

Zoetis Inc. (Exact name of registrant as specified in its charter)

Delaware001-3579746-0696167 (State or other jurisdiction(Commission File(I.R.S. Employer of incorporation)Number)Identification No.)

10 Sylvan Way Parsippany New Jersey 07054 (Address of principal executive offices)(Zip Code)

(973) 822-7000

(Registrant's telephone number, including area code)

Not Applicable (Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: Title of each classTrading Symbol(s)Name of each exchange on which registered Common Stock, par value $0.01 per shareZTSNew York Stock Exchange

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 5, 2025, Zoetis Inc. (the Company) issued a press release reporting its financial results for the second quarter of 2025 and its guidance for full year 2025. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and the attached Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. Item 9.01 Financial Statements and Exhibits

(d) Exhibits Exhibit No.Description

99.1 Press Release of Zoetis Inc. dated August 5, 2025, reporting Zoetis' financial results for the

second quarter of 2025 and its guidance for full year 2025.

EX-101.INSInline XBRL INSTANCE DOCUMENT

EX-101.SCHInline XBRL TAXONOMY EXTENSION SCHEMA DOCUMENT

EX-101.CALInline XBRL TAXONOMY EXTENSION CALCULATION LINKBASE DOCUMENT

EX-101.LABInline XBRL TAXONOMY EXTENSION LABEL LINKBASE DOCUMENT

EX-101.PREInline XBRL TAXONOMY EXTENSION PRESENTATION LINKBASE DOCUMENT

EX-101.DEFInline XBRL TAXONOMY EXTENSION DEFINITION LINKBASE DOCUMENT

104Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

SIGNATURE

Under the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the authorized undersigned.

Zoetis Inc.

August 5, 2025 By:/S/ WETTENY JOSEPH Wetteny Joseph Executive Vice President and Chief Financial Officer

Latest Zoetis Inc. News

ZTS Breaking Stock News: Dive into ZTS Ticker-Specific Updates for Smart Investing

Jensen Exit Puts Zoetis Growth Pipeline And Valuation In Spotlight

AI Sentiment

Negative

3/10

Marvell upgraded, Trade Desk downgraded: Wall Street's top analyst calls

AI Sentiment

Highly Positive

9/10

Jensen Quality Growth Equity Strategy Decided to Sell Its Stake in Zoetis (ZTS)

AI Sentiment

Neutral

4/10

Here Are Friday’s Top Wall Street Analyst Research Calls: BorgWarner, CoreWeave, Intuit, Marvell Technology, Netflix, Okta, Regeneron Pharmaceuticals, Trade Desk, and More

AI Sentiment

Negative

3/10

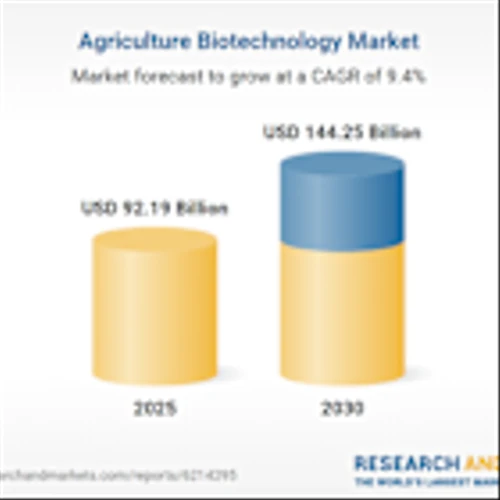

Agriculture Biotechnology Industry Research and Global Forecast Report 2025-2030, Profiles of Prominent Players - Bayer, Corteva Agriscience, BASF, Syngenta, Zoetis, Elanco Animal Health, Novonesis

AI Sentiment

Highly Positive

9/10

Compare ZTS vs Leading Stocks

See how ZTS stacks up against similar companies in the market

Head-to-Head Comparisons

Share on Social Networks:

Tools & Resources

Enhance your trading experience with our free tools

Disclaimer

The information presented on this page, "ZTS Zoetis Inc. - Stocks Price | History | Analysis", including historical data, forecasts, news, insider information, and predictions, is provided for educational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities. Decisions regarding investments should be made only after careful consideration and consultation with a qualified financial advisor. We do not endorse or guarantee the accuracy or reliability of the information provided, and we disclaim any liability for financial losses incurred as a result of decisions made based on the information presented.