- Home

- ROK

as of 02-27-2026 3:36pm EST

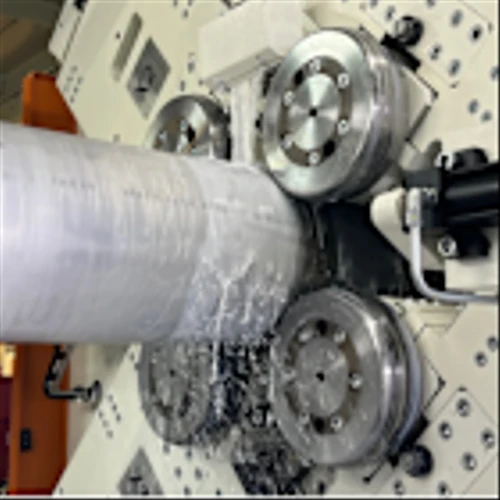

With roots tracing back to the early 1900s, Rockwell Automation is the successor to Rockwell International, which spun off its avionics segment in 2001. It is a pure-play industrial automation company that operates through three segments. Its largest segment by revenue, intelligent devices, sells factory floor-level devices such as motors, drives, sensors, relays, and actuators. Its software and control segment sells visualization, simulation, and human-machine interface software and control products such as programmable controllers, computers, and operator terminals. Its smallest segment, lifecycle services, offers digital consulting, engineered-to-order services, and other outsourced services such as remote monitoring, cybersecurity, and asset and plant maintenance and optimization.

| Founded: | 1903 | Country: | United States |

| Employees: | N/A | City: | MILWAUKEE |

| Market Cap: | 47.3B | IPO Year: | 2004 |

| Target Price: | $414.64 | AVG Volume (30 days): | 1.2M |

| Analyst Decision: | Buy | Number of Analysts: | 15 |

| Dividend Yield: | Dividend Payout Frequency: | semi-annual | |

| EPS: | 2.69 | EPS Growth: | -7.37 |

| 52 Week Low/High: | $215.00 - $438.72 | Next Earning Date: | 05-07-2026 |

| Revenue: | $6,666,000,000 | Revenue Growth: | 5.62% |

| Revenue Growth (this year): | 7.32% | Revenue Growth (next year): | 6.01% |

| P/E Ratio: | 152.33 | Index: | |

| Free Cash Flow: | 1.4B | FCF Growth: | +27.71% |

AI-Powered ROK Daily Prediction

Machine learning model trained on 25+ technical indicators

AI Recommendation

Disclaimer: This prediction is generated by an AI model and should not be considered as financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

Stock Insider Trading Activity of Rockwell Automation Inc. (ROK)

SVP, Chief Information Officer

Avg Cost/Share

$410.01

Shares

14,465

Total Value

$5,930,806.22

Owned After

14,232

SEC Form 4

Sr.VP, Chief Revenue Officer

Avg Cost/Share

$405.73

Shares

17,407

Total Value

$7,043,125.92

Owned After

10,334

Vice President and Treasurer

Avg Cost/Share

$405.60

Shares

1,271

Total Value

$515,628.22

Owned After

2,738

SVP, Intelligent Devices

Avg Cost/Share

$409.37

Shares

1,985

Total Value

$812,599.45

Owned After

4,036

SEC Form 4

SVP Lifecycle Services

Avg Cost/Share

$404.90

Shares

1,200

Total Value

$485,050.44

Owned After

5,202

SVP, CLO and Secretary

Avg Cost/Share

$405.10

Shares

12,100

Total Value

$4,891,715.92

Owned After

12,900

SVP,Chief Supply Chain Officer

Avg Cost/Share

$380.14

Shares

204

Total Value

$77,548.46

Owned After

3,278

SEC Form 4

Vice President and Controller

Avg Cost/Share

$392.00

Shares

800

Total Value

$313,600.00

Owned After

1,234

SEC Form 4

SVP, Chief Technology Officer

Avg Cost/Share

$402.40

Shares

804

Total Value

$323,248.05

Owned After

6,477

SVP,Chief Supply Chain Officer

Avg Cost/Share

$402.28

Shares

229

Total Value

$92,039.44

Owned After

3,278

| Insider | Ticker | Relationship | Date | Transaction | Avg Cost | Shares | Total Value | Owned After | SEC Forms |

|---|---|---|---|---|---|---|---|---|---|

| Nardecchia Christopher | ROK | SVP, Chief Information Officer | Feb 26, 2026 | Sell | $410.01 | 14,465 | $5,930,806.22 | 14,232 | |

| GENEREUX SCOTT | ROK | Sr.VP, Chief Revenue Officer | Feb 25, 2026 | Sell | $405.73 | 17,407 | $7,043,125.92 | 10,334 | |

| Woods Isaac | ROK | Vice President and Treasurer | Feb 25, 2026 | Sell | $405.60 | 1,271 | $515,628.22 | 2,738 | |

| Myers Tessa M. | ROK | SVP, Intelligent Devices | Feb 25, 2026 | Sell | $409.37 | 1,985 | $812,599.45 | 4,036 | |

| Fordenwalt Matthew W. | ROK | SVP Lifecycle Services | Feb 25, 2026 | Sell | $404.90 | 1,200 | $485,050.44 | 5,202 | |

| House Rebecca W | ROK | SVP, CLO and Secretary | Feb 25, 2026 | Sell | $405.10 | 12,100 | $4,891,715.92 | 12,900 | |

| Buttermore Robert L. | ROK | SVP,Chief Supply Chain Officer | Feb 17, 2026 | Sell | $380.14 | 204 | $77,548.46 | 3,278 | |

| Riesterer Terry L. | ROK | Vice President and Controller | Jan 2, 2026 | Sell | $392.00 | 800 | $313,600.00 | 1,234 | |

| Perducat Cyril | ROK | SVP, Chief Technology Officer | Dec 10, 2025 | Sell | $402.40 | 804 | $323,248.05 | 6,477 | |

| Buttermore Robert L. | ROK | SVP,Chief Supply Chain Officer | Dec 10, 2025 | Sell | $402.28 | 229 | $92,039.44 | 3,278 |

Latest Rockwell Automation Inc. News

ROK Breaking Stock News: Dive into ROK Ticker-Specific Updates for Smart Investing

Internet of Things Stocks Q4 In Review: Rockwell Automation (NYSE:ROK) Vs Peers

AI Sentiment

Neutral

5/10

Rockwell Automation (ROK) Valuation Check After Bologna Customer Experience Center Launch

AI Sentiment

Positive

7/10

2 Cash-Producing Stocks Worth Your Attention and 1 We Find Risky

AI Sentiment

Neutral

4/10

Reducing Energy Consumed by Hydraulic Power Systems by up to 80%

AI Sentiment

Highly Positive

9/10

New research shows top OEMs cut downtime recovery by 40%, strengthening profitability through resilience-first strategies

AI Sentiment

Highly Positive

9/10

Compare ROK vs Leading Stocks

See how ROK stacks up against similar companies in the market

Head-to-Head Comparisons

Share on Social Networks:

Tools & Resources

Enhance your trading experience with our free tools

Disclaimer

The information presented on this page, "ROK Rockwell Automation Inc. - Stocks Price | History | Analysis", including historical data, forecasts, news, insider information, and predictions, is provided for educational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities. Decisions regarding investments should be made only after careful consideration and consultation with a qualified financial advisor. We do not endorse or guarantee the accuracy or reliability of the information provided, and we disclaim any liability for financial losses incurred as a result of decisions made based on the information presented.