- Home

- NAVI

NAVI

Navient Corporation

as 07-18-2025 12:37pm EST

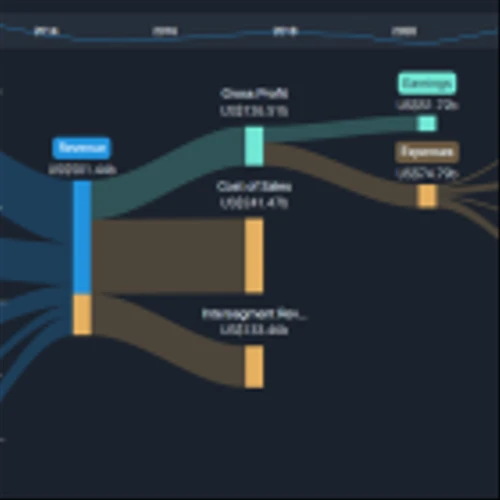

Navient Corp provides technology-enabled education finance solutions that simplify complex programs and help millions of people achieve success. The company operates its business in three segments: Federal Education Loans, Consumer Lending, and Business Processing. A majority of its revenue is generated from the Federal Education Loans segment, in which the company owns and manages the Federal Family Education Loan Program (FFELP) loans, generating revenue mainly in the form of net interest income. The Consumer Lending segment owns and manages private education loans and is the master servicer for these portfolios. Through its Earnest brand, the company also refinances and originates in-school private educational loans.

| Founded: | 1973 | Country: | United States |

| Employees: | N/A | City: | HERNDON |

| Market Cap: | 1.4B | IPO Year: | N/A |

| Target Price: | $14.43 | AVG Volume (30 days): | 953.3K |

| Analyst Decision: | Hold | Number of Analysts: | 7 |

| Dividend Yield: | Dividend Payout Frequency: | Quarterly | |

| EPS: | 0.52 | EPS Growth: | -67.31 |

| 52 Week Low/High: | $10.53 - $16.96 | Next Earning Date: | 07-28-2025 |

| Revenue: | $699,000,000 | Revenue Growth: | -36.16% |

| Revenue Growth (this year): | -32.28% | Revenue Growth (next year): | 0.56% |

Latest Navient Corporation News

NAVI Breaking Stock News: Dive into NAVI Ticker-Specific Updates for Smart Investing

Argus Research

24 days ago

NAVI: What does Argus have to say about NAVI?

Argus Research

a month ago

NAVI: What does Argus have to say about NAVI?

GlobeNewswire

a month ago

Navient holds 2025 annual shareholder meeting, appoints Edward Bramson as board chair

Simply Wall St.

2 months ago

Navient (NASDAQ:NAVI) Will Pay A Dividend Of $0.16

Argus Research

2 months ago

NAVI: Raising target price to $11.00

GlobeNewswire

2 months ago

Navient declares second quarter common stock dividend

Argus Research

2 months ago

NAVI: What does Argus have to say about NAVI?

Simply Wall St.

2 months ago

Navient First Quarter 2025 Earnings: Misses Expectations

Compare NAVI vs Leading Stocks

Share on Social Networks:

Disclaimer

The information presented on this page, "NAVI Navient Corporation - Stocks Price | History | Analysis", including historical data, forecasts, news, insider information, and predictions, is provided for educational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities. Decisions regarding investments should be made only after careful consideration and consultation with a qualified financial advisor. We do not endorse or guarantee the accuracy or reliability of the information provided, and we disclaim any liability for financial losses incurred as a result of decisions made based on the information presented.