Take the Zacks Approach to Beat the Markets: Intellia, Colgate-Palmolive, Getty in Focus

AI Sentiment

Highly Positive

9/10

as of 02-24-2026 9:36am EST

Hershey is a leading US confectionery manufacturer (around a $54 billion market, according to Euromonitor), controlling around 36% of the domestic chocolate aisle. Beyond its namesake label, the firm's portfolio has expanded over the last 85 years and now comprises 100 brands, including Reese's, Kit Kat, Kisses, and Ice Breakers. Hershey's products are sold in about 80 countries, albeit with just a high-single-digit percentage of sales coming from markets outside the US, including Brazil, India, and Mexico. The firm has sought inorganic opportunities to extend its reach beyond its core confectionery business, adding Amplify Snack Brands and its Skinny Pop ready-to-eat popcorn to its portfolio, as well as Pirate Brands and Dot's Pretzels over the past few years.

| Founded: | 1894 | Country: | United States |

| Employees: | 17550 | City: | HERSHEY |

| Market Cap: | 37.4B | IPO Year: | 2004 |

| Target Price: | $210.67 | AVG Volume (30 days): | 2.2M |

| Analyst Decision: | Hold | Number of Analysts: | 15 |

| Dividend Yield: | Dividend Payout Frequency: | semi-annual | |

| EPS: | 0.64 | EPS Growth: | N/A |

| 52 Week Low/High: | $150.04 - $234.87 | Next Earning Date: | 05-07-2026 |

| Revenue: | $8,149,719,000 | Revenue Growth: | 2.05% |

| Revenue Growth (this year): | 5.71% | Revenue Growth (next year): | 2.34% |

| P/E Ratio: | 355.39 | Index: | |

| Free Cash Flow: | 1.8B | FCF Growth: | -5.34% |

Machine learning model trained on 25+ technical indicators

Disclaimer: This prediction is generated by an AI model and should not be considered as financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

SVP, Chief Financial Officer

Avg Cost/Share

$198.67

Shares

1,500

Total Value

$298,005.00

Owned After

52,319

SEC Form 4

Director

Avg Cost/Share

$184.10

Shares

130

Total Value

$23,933.00

Owned After

1,408.51

SEC Form 4

SVP, Chief Financial Officer

Avg Cost/Share

$188.51

Shares

1,500

Total Value

$282,765.00

Owned After

52,319

SEC Form 4

| Insider | Ticker | Relationship | Date | Transaction | Avg Cost | Shares | Total Value | Owned After | SEC Forms |

|---|---|---|---|---|---|---|---|---|---|

| Voskuil Steven E | HSY | SVP, Chief Financial Officer | Jan 20, 2026 | Sell | $198.67 | 1,500 | $298,005.00 | 52,319 | |

| Robbin-Coker Cordel | HSY | Director | Jan 5, 2026 | Sell | $184.10 | 130 | $23,933.00 | 1,408.51 | |

| Voskuil Steven E | HSY | SVP, Chief Financial Officer | Dec 18, 2025 | Sell | $188.51 | 1,500 | $282,765.00 | 52,319 |

HSY Breaking Stock News: Dive into HSY Ticker-Specific Updates for Smart Investing

AI Sentiment

Highly Positive

9/10

AI Sentiment

Highly Positive

8/10

AI Sentiment

Highly Positive

9/10

AI Sentiment

Positive

6/10

AI Sentiment

Negative

3/10

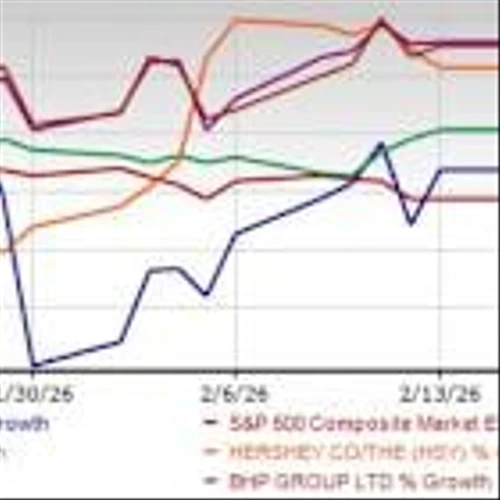

See how HSY stacks up against similar companies in the market

Enhance your trading experience with our free tools

The information presented on this page, "HSY The Hershey Company - Stocks Price | History | Analysis", including historical data, forecasts, news, insider information, and predictions, is provided for educational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities. Decisions regarding investments should be made only after careful consideration and consultation with a qualified financial advisor. We do not endorse or guarantee the accuracy or reliability of the information provided, and we disclaim any liability for financial losses incurred as a result of decisions made based on the information presented.