- Home

- GM

as of 02-25-2026 4:00pm EST

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under three segments: GM North America, GM International, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its US market share leadership in 2022, after losing it to Toyota due to the chip shortage in 2021. 2025 US share was 17.5%. The Cruise autonomous vehicle arm, which GM now owns outright, previously operated driverless geofenced AV robotaxi services in San Francisco and other cities, but after a 2023 accident, GM decided that it will focus on personal AVs. GM Financial became the company's captive finance arm in 2010 via the purchase of AmeriCredit.

| Founded: | 1908 | Country: | United States |

| Employees: | N/A | City: | DETROIT |

| Market Cap: | 74.3B | IPO Year: | 2010 |

| Target Price: | $89.55 | AVG Volume (30 days): | 8.0M |

| Analyst Decision: | Buy | Number of Analysts: | 20 |

| Dividend Yield: | Dividend Payout Frequency: | quarterly | |

| EPS: | 3.27 | EPS Growth: | -48.67 |

| 52 Week Low/High: | $41.60 - $87.62 | Next Earning Date: | 04-27-2026 |

| Revenue: | $185,019,000,000 | Revenue Growth: | -1.29% |

| Revenue Growth (this year): | 3.61% | Revenue Growth (next year): | 2.29% |

| P/E Ratio: | 24.86 | Index: | |

| Free Cash Flow: | 17.6B | FCF Growth: | +88.88% |

AI-Powered GM Daily Prediction

Machine learning model trained on 25+ technical indicators

AI Recommendation

Disclaimer: This prediction is generated by an AI model and should not be considered as financial advice. Always conduct your own research and consult with financial professionals before making investment decisions.

Stock Insider Trading Activity of General Motors Company (GM)

President

Avg Cost/Share

$80.57

Shares

480,724

Total Value

$38,709,454.92

Owned After

342,959

| Insider | Ticker | Relationship | Date | Transaction | Avg Cost | Shares | Total Value | Owned After | SEC Forms |

|---|---|---|---|---|---|---|---|---|---|

| Reuss Mark L | GM | President | Feb 17, 2026 | Sell | $80.57 | 480,724 | $38,709,454.92 | 342,959 |

Latest General Motors Company News

GM Breaking Stock News: Dive into GM Ticker-Specific Updates for Smart Investing

Lithium Americas Thacker Pass Update Highlights Execution Risks And Governance Shift

AI Sentiment

Positive

6/10

Tesla Is Suing California, Says Report. What It Means for the Stock.

AI Sentiment

Negative

3/10

The Anti-AI Trade Is Red Hot. Here’s What’s Beating Artificial- Intelligence Stocks.

AI Sentiment

Positive

7/10

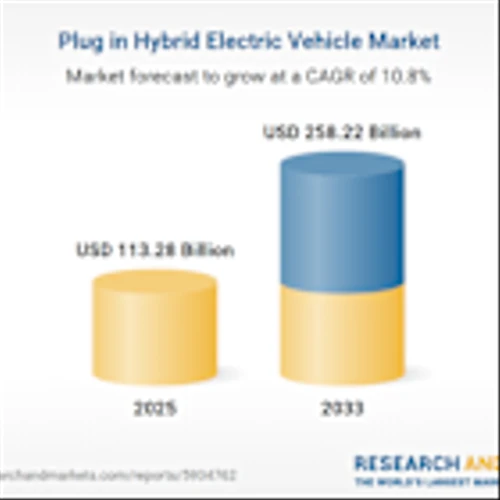

Plug in Hybrid Electric Vehicle Competitive Landscape Report 2025: Key Players Analysis, Profiles, Product Developments, Mergers, Strategic Collaborations, and Revenue Forecast Insights to 2033

AI Sentiment

Highly Positive

9/10

Compare GM vs Leading Stocks

See how GM stacks up against similar companies in the market

Head-to-Head Comparisons

Share on Social Networks:

Tools & Resources

Enhance your trading experience with our free tools

Disclaimer

The information presented on this page, "GM General Motors Company - Stocks Price | History | Analysis", including historical data, forecasts, news, insider information, and predictions, is provided for educational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities. Decisions regarding investments should be made only after careful consideration and consultation with a qualified financial advisor. We do not endorse or guarantee the accuracy or reliability of the information provided, and we disclaim any liability for financial losses incurred as a result of decisions made based on the information presented.