- Home

- PLXS vs VAL Comparison

PLXS vs VAL Comparison

Compare PLXS & VAL Stocks: Price Trends, ML Decisions, Charts, Trends, Technical Analysis and more.

Current Price

Company Overview

Basic Information| Metric | PLXS | VAL |

|---|---|---|

| Founded | 1979 | 1975 |

| Country | United States | Bermuda |

| Employees | N/A | N/A |

| Industry | Electrical Products | Oil & Gas Production |

| Sector | Technology | Energy |

| Exchange | Nasdaq | Nasdaq |

| Market Cap | 4.0B | 3.9B |

| IPO Year | 1986 | N/A |

Fundamental Metrics

Financial Performance| Metric | PLXS | VAL |

|---|---|---|

| Price | $153.07 | $49.50 |

| Analyst Decision | Strong Buy | Hold |

| Analyst Count | 3 | 5 |

| Target Price | ★ $160.00 | $55.60 |

| AVG Volume (30 Days) | 220.3K | ★ 1.2M |

| Earning Date | 01-21-2026 | 10-29-2025 |

| Dividend Yield | N/A | N/A |

| EPS Growth | ★ 56.11 | N/A |

| EPS | ★ 6.26 | 5.61 |

| Revenue | ★ $4,032,966,000.00 | $2,416,000,000.00 |

| Revenue This Year | $10.99 | N/A |

| Revenue Next Year | $7.02 | N/A |

| P/E Ratio | $24.49 | ★ $8.83 |

| Revenue Growth | 1.82 | ★ 6.81 |

| 52 Week Low | $103.43 | $27.15 |

| 52 Week High | $172.89 | $61.70 |

Technical Indicators

Market Signals| Indicator | PLXS | VAL |

|---|---|---|

| Relative Strength Index (RSI) | 53.86 | 33.16 |

| Support Level | $147.43 | $48.09 |

| Resistance Level | $166.91 | $61.70 |

| Average True Range (ATR) | 6.10 | 2.40 |

| MACD | -0.31 | -1.19 |

| Stochastic Oscillator | 42.46 | 10.39 |

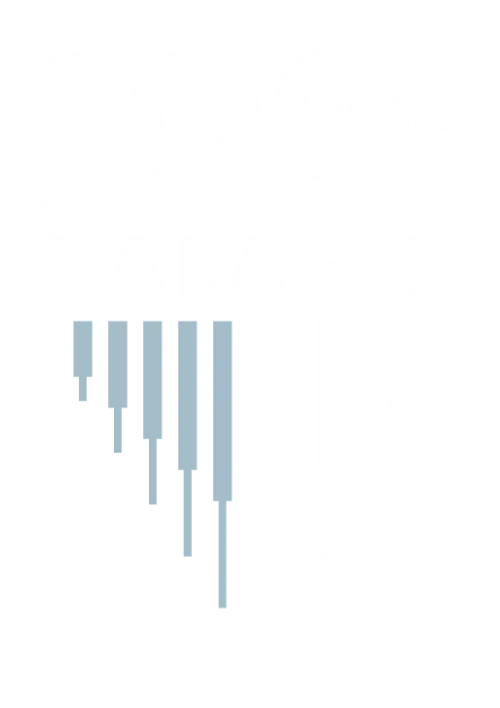

Price Performance

Historical ComparisonAbout PLXS Plexus Corp.

Plexus Corp designs, manufactures, and services complex products in demanding regulatory environments, supporting life-saving medical devices, mission-critical aerospace and defense products, industrial automation systems, and semiconductor capital equipment. Its integrated lifecycle solutions span design and development, supply chain solutions, new product introduction, manufacturing, and sustaining services for market and disruptive companies in the Aerospace/Defense, Healthcare/Life Sciences, and Industrial sectors. The Company operates through three reportable segments: AMER, APAC, and EMEA, with the majority of revenue from the APAC segment.

About VAL Valaris Limited

Valaris Ltd is an offshore contract drilling company. The company provides offshore contract drilling services to the international oil and gas industry with operations in almost every offshore market across six continents. Its business consists of four operating segments: Floaters, which includes drillships and semisubmersible rigs; Jackups; ARO; and Other, which consists of management services on rigs owned by third parties. It generates the majority of its revenue from the Floaters segment.