- Home

- ASAN vs VAL Comparison

ASAN vs VAL Comparison

Compare ASAN & VAL Stocks: Price Trends, ML Decisions, Charts, Trends, Technical Analysis and more.

- Machine Learning Prediction

- ML Decision

- ASAN

- VAL

- Stock Information

- Founded

- ASAN 2008

- VAL 1975

- Country

- ASAN United States

- VAL Bermuda

- Employees

- ASAN N/A

- VAL N/A

- Industry

- ASAN Retail: Computer Software & Peripheral Equipment

- VAL Oil & Gas Production

- Sector

- ASAN Technology

- VAL Energy

- Exchange

- ASAN Nasdaq

- VAL Nasdaq

- Market Cap

- ASAN 3.3B

- VAL 3.9B

- IPO Year

- ASAN 2020

- VAL N/A

- Fundamental

- Price

- ASAN $12.41

- VAL $56.08

- Analyst Decision

- ASAN Hold

- VAL Hold

- Analyst Count

- ASAN 14

- VAL 7

- Target Price

- ASAN $17.04

- VAL $52.14

- AVG Volume (30 Days)

- ASAN 3.5M

- VAL 948.8K

- Earning Date

- ASAN 12-02-2025

- VAL 10-29-2025

- Dividend Yield

- ASAN N/A

- VAL N/A

- EPS Growth

- ASAN N/A

- VAL N/A

- EPS

- ASAN N/A

- VAL 5.61

- Revenue

- ASAN $756,419,000.00

- VAL $2,416,000,000.00

- Revenue This Year

- ASAN $10.81

- VAL N/A

- Revenue Next Year

- ASAN $8.52

- VAL N/A

- P/E Ratio

- ASAN N/A

- VAL $9.99

- Revenue Growth

- ASAN 9.74

- VAL 6.81

- 52 Week Low

- ASAN $11.58

- VAL $27.15

- 52 Week High

- ASAN $27.77

- VAL $58.85

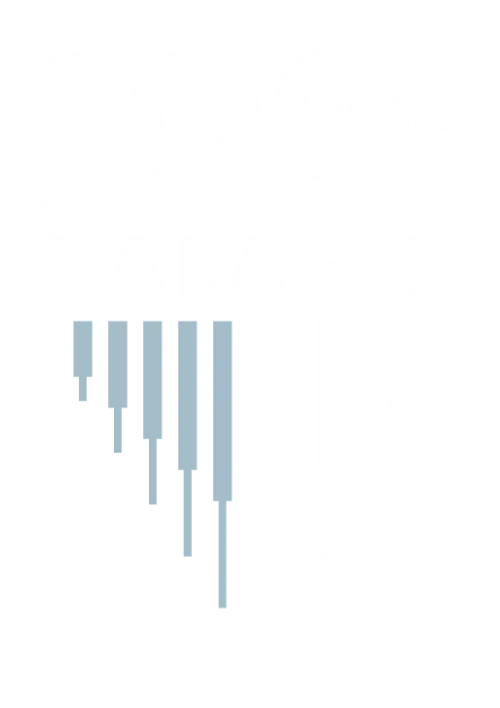

- Technical

- Relative Strength Index (RSI)

- ASAN 39.05

- VAL 54.46

- Support Level

- ASAN $11.66

- VAL $51.50

- Resistance Level

- ASAN $12.48

- VAL $57.06

- Average True Range (ATR)

- ASAN 0.53

- VAL 2.37

- MACD

- ASAN -0.04

- VAL -0.32

- Stochastic Oscillator

- ASAN 38.86

- VAL 61.09

About ASAN Asana Inc.

Asana is a provider of collaborative work management software delivered via a cloud-based SaaS model. The firm's solution offers scalable, dynamic tools to improve the efficiency of project and process management across countless use cases, including marketing programs, managing IT approvals, and performance management. Asana's offering supports workflow management across teams, provides real time visibility into projects, and reporting and automation capabilities. The firm generates revenue via software subscriptions on a per seat basis.

About VAL Valaris Limited

Valaris Ltd is an offshore contract drilling company. The company provides offshore contract drilling services to the international oil and gas industry with operations in almost every offshore market across six continents. Its business consists of four operating segments: Floaters, which includes drillships and semisubmersible rigs; Jackups; ARO; and Other, which consists of management services on rigs owned by third parties. It generates the majority of its revenue from the Floaters segment.