- Home

- SOLV

SOLV

SOLVENTUM CORP

as 06-30-2025 3:33pm EST

Stocks

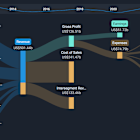

Solventum Corp is a healthcare company developing, manufacturing, and commercializing a portfolio of solutions that leverage deep material science, data science, and digital capabilities to address critical customer and patient needs. The company has four operating segments: MedSurg, Dental Solutions, Health Information Systems, and Purification and Filtration. The company generates the majority of its revenue from the MedSurg segment, which provides wound care and surgical solutions that are intended to accelerate healing, prevent complications, and lower the total cost of care globally.

| Founded: | 2023 | Country: | United States |

| Employees: | N/A | City: | ST. PAUL |

| Market Cap: | 12.7B | IPO Year: | N/A |

| Target Price: | $80.29 | AVG Volume (30 days): | 786.6K |

| Analyst Decision: | Hold | Number of Analysts: | 10 |

| Dividend Yield: | N/A | Dividend Payout Frequency: | N/A |

| EPS: | 2.18 | EPS Growth: | -70.83 |

| 52 Week Low/High: | $47.16 - $85.92 | Next Earning Date: | 08-07-2025 |

| Revenue: | $8,308,000,000 | Revenue Growth: | 1.29% |

| Revenue Growth (this year): | 4.11% | Revenue Growth (next year): | 0.14% |

Latest SOLVENTUM CORP News

SOLV Breaking Stock News: Dive into SOLV Ticker-Specific Updates for Smart Investing

PR Newswire

12 days ago

Solventum Named a Best Company to Work for by U.S. News & World Report

Simply Wall St.

18 days ago

How Did Solventum Corporation's (NYSE:SOLV) 12% ROE Fare Against The Industry?

PR Newswire

a month ago

Solventum to Participate in the 2025 Goldman Sachs Health Care Conference

Investor's Business Daily

a month ago

Solventum Stock Earns RS Rating Upgrade

Simply Wall St.

a month ago

Solventum's (NYSE:SOLV) Problems Go Beyond Weak Profit

Simply Wall St.

2 months ago

Solventum First Quarter 2025 Earnings: Beats Expectations

PR Newswire

2 months ago

Solventum Reports First Quarter 2025 Financial Results

PR Newswire

2 months ago

Solventum to Participate in the 2025 BofA Securities Health Care Conference

Compare SOLV vs Leading Stocks

Share on Social Networks:

Disclaimer

The information presented on this page, "SOLV SOLVENTUM CORP - Stocks Price | History | Analysis", including historical data, forecasts, news, insider information, and predictions, is provided for educational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities. Decisions regarding investments should be made only after careful consideration and consultation with a qualified financial advisor. We do not endorse or guarantee the accuracy or reliability of the information provided, and we disclaim any liability for financial losses incurred as a result of decisions made based on the information presented.